It is always beneficial to network, but when should you seriously contemplate seeking investment and attending events like Davos to enhance your networking and promotion efforts? Let’s delve into the specifics of different funding rounds to determine when a Davos visit might be appropriate.

Firstly, it’s important to acknowledge that Davos primarily caters to B2B (business-to-business) interactions, and allocating a portion of your raised capital for marketing purposes is a common practice, usually around 5%.

Considering this, it’s advisable to consider attending Davos after reaching at least the Round B funding stage, but not before. Here’s why:

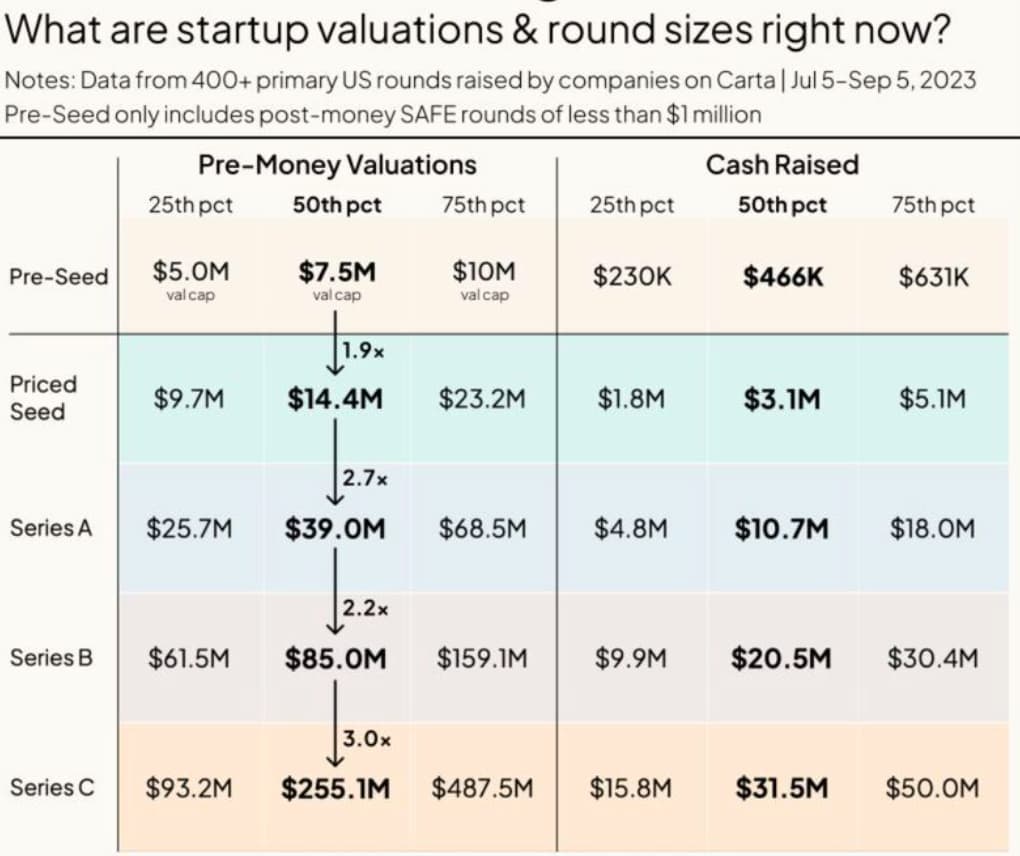

When we look at venture capital (VC) funding and the relationship between cash raised and pre-money valuation, it becomes clearer:

- Seed Stage (Pre-Seed and Seed Rounds): At this early stage, you’re typically in the process of proving your concept and building your product or service. Davos may not be the best investment of your time or resources at this point, as your focus should primarily be on product development and validation.

- Series A Round: By the time you’ve reached the Series A round, you’ve likely achieved some market traction and established a more solid foundation for your business. However, it may still be early for Davos, as you should concentrate on scaling your operations and fine-tuning your business model.

- Series B and Beyond: Davos can become a valuable opportunity to showcase your company and engage with potential partners, investors, and clients once you’ve successfully navigated the early stages and have significant capital to allocate. Round B or later rounds are usually the point at which you can consider participating in events like Davos effectively.

In summary, attending Davos and similar events should align with your company’s growth stage and available resources. It’s typically advisable to wait until Round B or later, when you have a more established presence and sufficient capital to make the most of these networking opportunities. Understanding the relationship between cash raised, pre-money valuation, and your business’s development stage will help you make informed decisions about when to embark on such endeavors.