“Of 60 institutions surveyed in the U.S., Europe and the U.K., an astounding 48% reported currently managing digital assets for their clients.”

I expect the number of offices/funds/firms to add digital assets to their portfolio to balloon in the coming years. The early adopters of digital assets were largely smaller (in AUM). As the crypto investing space matures, I expect some of the larger players to also enter the fray in the burgeoning crypto investment sector. Nearly Half Of Institutions Are Holding Digital Assets For Clients: Report - Decrypt

1 Like

Looks like this has been growing significantly since 1-2 years ago. Seems like there’s still a gap (client demand for digital asset exposure is outpacing wealth manager supply) but it’s starting to narrow a little bit.

1 Like

I also saw a Coinbase survey that indicates a notable uptick in institutional crypto investment.

Some insights:

- Over the next three years, 64% of current investors aim to up their allocations.

- 45% of institutional investors surveyed without crypto allocations expect to allocate in the next three years

- 57% of institutional investors surveyed believe prices will move higher in the next 12 months, compared to just 8% who shared that view in October 2022, and,

- Respondents believe that blockchain can replace legacy payment and trade settlement rails in the future

We’re witnessing a significant shift.

2 Likes

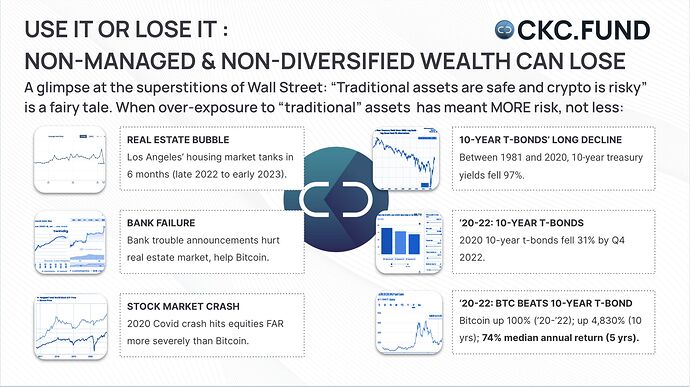

Contrary to the widespread belief that traditional assets such as stocks, bonds, and real estate are universally safe and cryptocurrencies are inherently risky, the reality is often much more nuanced. In many cases, over-reliance on so-called “safe” assets can actually increase risk over time. In a notable example, between 1981 and 2020, 10-year treasury yields fell 97%, while in contrast, Bitcoin saw a remarkable increase of around 5,000% in the same period.

For institutional investors, recognizing and navigating this nuanced landscape is crucial. The traditional wisdom of relying solely on established assets may not align with the ever-changing dynamics of global markets. Actively managing and diversifying institutional portfolios is imperative to adapt to evolving economic conditions.

In this context, exploring alternative assets like digital currencies becomes particularly relevant for institutional investors. These assets not only serve as a hedge against volatility in traditional markets but also present opportunities for asymmetric upside potential. The collaboration between professionals, including lawyers, accountants, industry experts, and regulators, is essential in constructing a diversified and resilient institutional portfolio.

For institutional investors, proactive financial management, adaptation to changing market conditions, and embracing a diversified approach that includes emerging assets like cryptocurrencies can be pivotal strategies in safeguarding and growing wealth over the long term.

2 Likes